StartupBus hackathon returns for its second Australian roadtrip

Lifestyle-driven coworking space Spaces launches in Melbourne ahead of Sydney opening

Richmond, an inner-city suburb of Melbourne three kilometres from Melbourne's CBD, was chosen by the company because of its high concentration of fashion, technology, and media businesses.

"We felt this was the perfect fit for Spaces’ inspirational style," the company stated in a written Q&A.

Like its other venues, Spaces' Melbourne branch provides a lifestyle-driven professional working environment, founded on principles of creativity, collaboration and inclusivity, while its design aims to reflect the company’s ‘Inspire to Work’ philosophy.

Managing Director at Spaces, Martijn Roordink, said people are more productive and subsequently more successful when they're in an enjoyable, social and inspiring work environment, and this is what Spaces wants to deliver. “Spaces gives members the opportunity to take their careers into their own hands and our events enable them to get involved in the buzz of the Spaces way of life. While our staff take care of all the day-to-day logistics of the workplace, our members are free to connect and get creative,” Roordink said. Spaces Melbourne occupies a 1,093 square metre area and features meeting rooms, private offices and ergonomically designed and engineered coworking spaces. An in-house Café Deli will serve complimentary freshly ground coffee from local roastery, Where’s Marcel?, as well as healthy snacks, lunches and pastries from boutique suppliers. Beers from the Goat Brewery will also be in stock during social events. Like many other coworking spaces, Spaces will host masterclass workshops, seminars and networking events for those who wish to engage with the community aspect of the brand. These events cater to Spaces' network of entrepreneurs, teams, small to medium enterprises and corporates. The usual stuff is also offered at Spaces like secretarial, business and virtual office services, mail and package handling, fast Wi-Fi and IT support on demand, and exclusive access to all Spaces locations globally including Amsterdam, The Hague, London and Melbourne, with Sydney, New York and Rotterdam soon to follow. Memberships start from $350 per month, while tenancies start from $720 per month. Contracts are flexible, so residents can sign up for as little as one month depending on their circumstances, while six and 12-month contracts are also available including rolling contracts after 12 months. Community Developer at Spaces, Margot Van Der Poel, said “Spaces delivers an inspiring, quality workplace platform, where Australian entrepreneurs and SMEs can network with like-minded people and make lasting connections. It offers a unique ‘creative community workspace’ that is relaxed and informal, while at the same time curating a productive and professional environment. “Australia as a nation has been heavily driving the notion of flexible working, which is why we selected Melbourne as our next location after Amsterdam and London - even ahead of the New York venue." Here's a peek into Spaces Melbourne: [caption id="attachment_45308" align="aligncenter" width="600"] Clubroom, Spaces Melbourne[/caption]

[caption id="attachment_45309" align="aligncenter" width="659"]

Clubroom, Spaces Melbourne[/caption]

[caption id="attachment_45309" align="aligncenter" width="659"] Couches & Bookcase Room, Spaces Melbourne[/caption]

[caption id="attachment_45310" align="aligncenter" width="660"]

Couches & Bookcase Room, Spaces Melbourne[/caption]

[caption id="attachment_45310" align="aligncenter" width="660"] Workspaces, Spaces Melbourne[/caption]

[caption id="attachment_45311" align="aligncenter" width="600"]

Workspaces, Spaces Melbourne[/caption]

[caption id="attachment_45311" align="aligncenter" width="600"] Meeting Room, Spaces Melbourne[/caption]

[caption id="attachment_45312" align="aligncenter" width="660"]

Meeting Room, Spaces Melbourne[/caption]

[caption id="attachment_45312" align="aligncenter" width="660"] Phone Booth, Spaces Melbourne[/caption]

Images: Spaces Melbourne. Source: Spacesworks.com.

Phone Booth, Spaces Melbourne[/caption]

Images: Spaces Melbourne. Source: Spacesworks.com.

SMS-based on-demand service ASAP merges with former rival Ketings, says it’s better to join forces than compete

Featured image: Kelvin Nguyen, Matt Keegan, Dylan Samra, & Daniel Cunningham, co-founders, ASAP. Source: Provided.

Malaysian angel investment firm QEERAD is looking to invest in Australian startups

Fintech startup zipMoney, which offers interest-free loans to online shoppers, makes ASX debut and enters high growth phase

Featured image: Larry Diamond, co-founder, zipMoney. Source: Provided.

Strategic partnership platform Collabosaurus experiences steady stream of revenue and growing user base within six months

This platform works through a matchmaking algorithm. Upon signup, a user is asked to enter details about the type of collaboration they’re interested in securing, their target market, and marketing assets, such as social media following, excess product or email database. The software then matches them with potential, valuable strategic partners.

The growth of Collabosaurus means founder Jessica Ruhfus, who was working a full time job as a marketer and PR representative, working as a barista part time, and tutoring HSC students while developing and launching the startup, has been able to give up the full time job. Though Ruhfus is fully dedicated to Collabosaurus, she's continued working part time as a barista and English tutor, explaining that she'll get bored if she's only doing one thing. Ruhfus said it's been exciting to see collaborations form through the platform. “The most common so far has been social media cross promotion. That’s as simple as two brands getting together and going, 'Well we have complementary products that our audience would be interested in' and they just do cross promotion,” Ruhfus said. The platform operates on a three-tiered subscription model, with the cheapest subscription setting users back $30 a month. This allows users to create one active project and send five requests to connect every month. Next up is the $60 per month subscription, targeting small businesses and startups, allowing for three active projects and 20 invitations to connect per month. The third tier costs $90 per month and allows for unlimited active projects and connections. This tier is aimed at larger businesses like PR, marketing, and events agencies. The free version of the platform allows users to set up projects and view matches, but does not offer connectivity. Of the 1,100 active users on Collabosaurus, Ruhfus said there are around 300 paying subscribers, though the flexible subscriptions mean numbers change from month to month; however, the platform is seeing a stable five percent subscription rate from month to month. These users are companies big and small, with Topshop recently using the platform to source a caterer for a collaboration in Melbourne. Ruhfus has been running events to market the platform and educate businesses about the value of strategic partnerships. Through this, she's seen her own network grow, hosting lunches with talks from people like Rewardle founder and CEO Ruwan Weerasoriya and Declan Lee, director and co-founder of Gelato Messina. The platform has already gone international, with a number of brands from North America and the UK joining Collabosaurus in its pre-launch stage. Ruhfus plans to properly expand into these markets over the coming months. “I had three separate completely unrelated businesses from Canada somehow find Collabosaurus and sign up. I got in touch with them straight away and because I had to know how they found us, why, if they think it's worth it, and with everyone I've spoken to so far, it seems there's quite a small business culture in Canada, it's quite similar to Australia. They have a lot of cool, creative things coming out of the works there and I think it would be an interesting one,” she said. Moving forward, Ruhfus sees the tech space as an opportunity for growth, with only a handful of tech companies currently using the platform, and will also be looking to target venues. “There are so many opportunities for venues, particularly in their off-peak hours. I'm always preaching ‘you have something someone else want’ and venues need to look at their space as a significant marketing and partnership asset. Goals for venues are usually social media growth, content creation, and overcoming the challenge of driving local newcomers into their venue to experience it first hand. Event partnerships for venues are extremely beneficial for achieving these goals and for valuable brand alignments with particular industries,” she said. Over 37 million people attended more than 412,000 business events in Australia in 2013-2014. These events generated $28 billion in direct expenditure, $13.5 billion in direct value added, and over 179,000 direct jobs. With these figures coming from business events alone, the potential in the wider market is much larger. Ruhfus believes a huge opportunity also lies in the nature of the collaborations brands work on. She said brands need to take advantage of creative ideas to provide value to each other's audiences. "Usually, the craziest or most creative collaborations get the most attention, and I'd love to see more of these that result in press exposure and exposure outside of social media alone," she said. Ruhfus envisions Collabosaurus being acquired by a company such as LinkedIn further down the line, but before that, she said it needs to establish itself in the market as “the go-to, original, and only source for strategic partnerships. We've had some competitors emerge that are so far unsuccessful, which we take as a compliment and a good sign. We're on track to being extremely desirable to potential acquirers and I'm loving every second of building this baby up!”Featured image: Jess Ruhfus, Founder, Collabosaurus. Source: Provided.

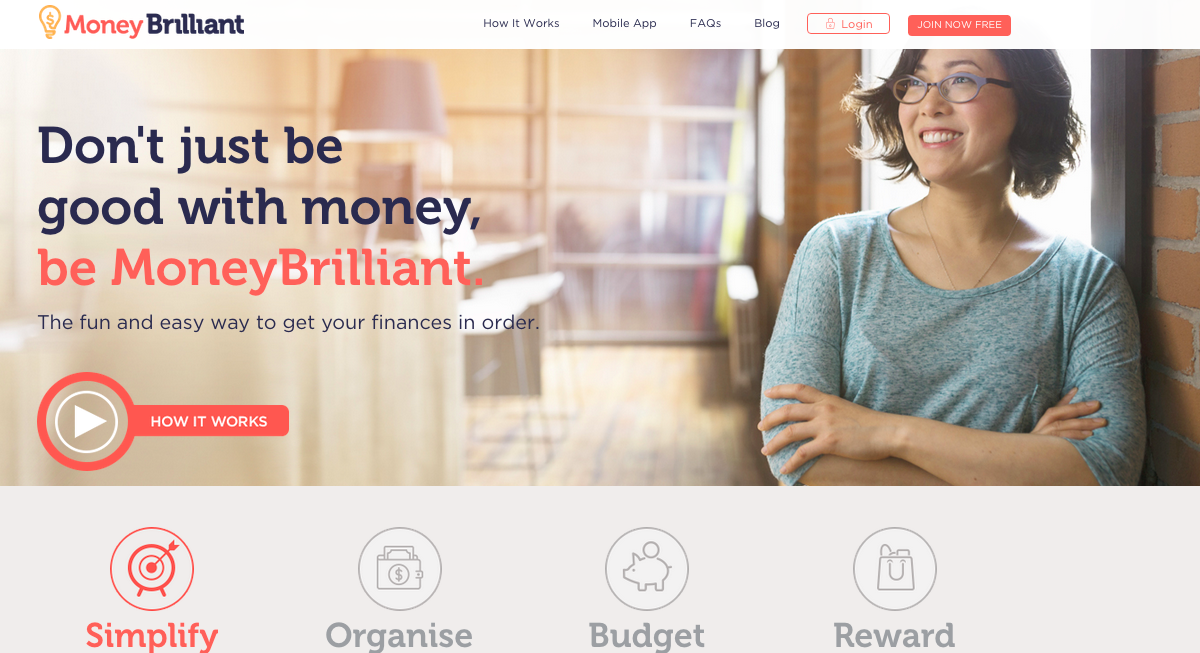

Will Sydney startup MoneyBrilliant be the winner in the personal finance management space?

MoneyBrilliant website screenshot[/caption]

MoneyBrilliant website screenshot[/caption]

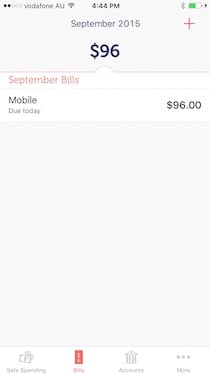

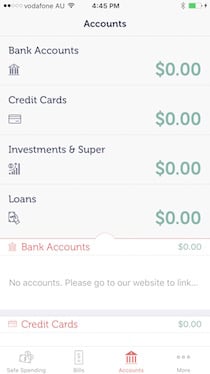

MoneyBrilliant’s core features include: aggregated balances and transactions for all bank, credit, loan, superannuation and investment accounts; instant categorisation of spending and trend reports; organisation of spending with the intelligence to remember user preferences; automatic bill finder and calendar; safe spending tracker for the user’s pay cycle; weekly money updates; and high levels of security using global banking technology company Yodlee.

At the moment, there are over 250 Australian-based institutions that can be connected to the platform, and hundreds more in nine different international markets.

Lord believes MoneyBrilliant’s ability to aggregate your superannuation data is its biggest point of difference. Australia’s superannuation funds are worth $1.94 trillion as of December 2014, yet most Australians have no clue of how much super they’ve accumulated.

"On the MoneyBrilliant app, you can easily see your super balance every day. I hope this helps people have more awareness around their super. Right now, to retire comfortably, you need about a $1 million in super, whereas the average super balance is close to $250,000. It's even lower for women. It’s hard to live on a pension - it’s too small, so super is going to be the key thing for people,” said Lord.

“I think research shows that 70% people think they're going to rely on super in retirement, but the percentage who actually do is closer to 25%.”

One thing the co-founders are adamant about is keeping customer data completely private. The co-founders confidently claim they won’t be monetising customer data or using it in any way other than to increase the value of MoneyBrilliant's offering.

“We think there is a growing nervousness amongst consumers as to what the ulterior motives are with different companies who have access to data. As a business, we are trying to position ourselves as a consumer champion, if you like, starting from giving people the opportunity to view their full financial picture. We need to build that trust, and [that trust] does start to dilute if you're using data in ways that [customers] haven’t consciously said okay to," said Enright.

“In the future, I guess it would make sense for us to help people find the right product and service provider through our app to [enhance] their financial life ... But the intent will be to do that in a way that is very transparent and completely independent.”

The startup has not yet monetised its offering, though the co-founders did say they’re steering towards a freemium model. This means basic features will be free, but power users will be able to upgrade to a premium version for a small monthly fee.

Enright said the startup is also working collaboratively with well-established businesses. Moving forward, the bigger companies will distribute MoneyBrilliant’s products to their customer base and there will be commercial terms around it.

In the early days, when MoneyBrilliant was called ‘Cha-Ching’, Lord had raised capital amongst family and friends. Late last year, the startup raised $1.5 million in funding from financial services company AMP. According to the startup, the partnership with AMP was brokered on a shared goal to make a positive impact on the financial well-being of Australians, with the startup approaching that challenge by focusing on the everyday – the basics of helping Australians pay bills, save and spend.

“We coined the phrase, the ‘Money Maslow’, to reflect our philosophy on financial well-being. If you don’t have the basic needs under control, like paying your bills and spending within your limits, you can’t have a conversation about goals and building wealth. You can’t get ahead,” Enright said.

The raised funds is being used primarily to recruit talent - MoneyBrilliant currently has a team of seven full-timers and casual workers - and is also being invested into marketing and other strategic customer acquisition activities.

“That money has allowed us to first and foremost bring the right talent into the business. Prior to that, our small founding team wore a lot of different hats. Post-investment, we've been able to grow our technology team, which is obviously a fundamental piece of our business. We have a great CTO, a great head of product and another talented developer, as well as a number of other roles,” said Enright.

The startup is currently experiencing about 50% month-on-month user growth. Though the co-founders did not disclose the number of users MoneyBrilliant has, Enright did say it’s “growing in the thousands each month” and that its users are based all over the world. Recently, Money Brilliant received requests from people in the US who are interested in using the product in full capacity.

At the moment, Facebook is proving to be the most effective channel for user acquisition and engagement.

“Facebook works really well for us, we found. Obviously, the nature of Facebook, it gives us more than user acquisition; it's giving us incredible insight into how people are feeling about our service. We’re getting a lot of reviews on there. We've been blown away by how many people are actually sharing our ad!” said Enright.

MoneyBrilliant is gearing up for an aggressive rollout of product developments beyond the current cash management service to move customers towards longer term financial well-being and to help users maximise their savings.

Lord admitted it’s been a rocky four-year startup journey, however, the ‘thank you’ notes he gets from users make it all worthwhile.

“I couldn't actually help my mum because she's in retirement now, but we're helping so many other Australians, taking away their stress. I love getting notes saying 'thank you',” said Lord.

Featured image (L to R): Jemma Enright, Co-Founder & CEO and Peter Lord, Founder, MoneyBrilliant. Source: Provided.

MoneyBrilliant’s core features include: aggregated balances and transactions for all bank, credit, loan, superannuation and investment accounts; instant categorisation of spending and trend reports; organisation of spending with the intelligence to remember user preferences; automatic bill finder and calendar; safe spending tracker for the user’s pay cycle; weekly money updates; and high levels of security using global banking technology company Yodlee.

At the moment, there are over 250 Australian-based institutions that can be connected to the platform, and hundreds more in nine different international markets.

Lord believes MoneyBrilliant’s ability to aggregate your superannuation data is its biggest point of difference. Australia’s superannuation funds are worth $1.94 trillion as of December 2014, yet most Australians have no clue of how much super they’ve accumulated.

"On the MoneyBrilliant app, you can easily see your super balance every day. I hope this helps people have more awareness around their super. Right now, to retire comfortably, you need about a $1 million in super, whereas the average super balance is close to $250,000. It's even lower for women. It’s hard to live on a pension - it’s too small, so super is going to be the key thing for people,” said Lord.

“I think research shows that 70% people think they're going to rely on super in retirement, but the percentage who actually do is closer to 25%.”

One thing the co-founders are adamant about is keeping customer data completely private. The co-founders confidently claim they won’t be monetising customer data or using it in any way other than to increase the value of MoneyBrilliant's offering.

“We think there is a growing nervousness amongst consumers as to what the ulterior motives are with different companies who have access to data. As a business, we are trying to position ourselves as a consumer champion, if you like, starting from giving people the opportunity to view their full financial picture. We need to build that trust, and [that trust] does start to dilute if you're using data in ways that [customers] haven’t consciously said okay to," said Enright.

“In the future, I guess it would make sense for us to help people find the right product and service provider through our app to [enhance] their financial life ... But the intent will be to do that in a way that is very transparent and completely independent.”

The startup has not yet monetised its offering, though the co-founders did say they’re steering towards a freemium model. This means basic features will be free, but power users will be able to upgrade to a premium version for a small monthly fee.

Enright said the startup is also working collaboratively with well-established businesses. Moving forward, the bigger companies will distribute MoneyBrilliant’s products to their customer base and there will be commercial terms around it.

In the early days, when MoneyBrilliant was called ‘Cha-Ching’, Lord had raised capital amongst family and friends. Late last year, the startup raised $1.5 million in funding from financial services company AMP. According to the startup, the partnership with AMP was brokered on a shared goal to make a positive impact on the financial well-being of Australians, with the startup approaching that challenge by focusing on the everyday – the basics of helping Australians pay bills, save and spend.

“We coined the phrase, the ‘Money Maslow’, to reflect our philosophy on financial well-being. If you don’t have the basic needs under control, like paying your bills and spending within your limits, you can’t have a conversation about goals and building wealth. You can’t get ahead,” Enright said.

The raised funds is being used primarily to recruit talent - MoneyBrilliant currently has a team of seven full-timers and casual workers - and is also being invested into marketing and other strategic customer acquisition activities.

“That money has allowed us to first and foremost bring the right talent into the business. Prior to that, our small founding team wore a lot of different hats. Post-investment, we've been able to grow our technology team, which is obviously a fundamental piece of our business. We have a great CTO, a great head of product and another talented developer, as well as a number of other roles,” said Enright.

The startup is currently experiencing about 50% month-on-month user growth. Though the co-founders did not disclose the number of users MoneyBrilliant has, Enright did say it’s “growing in the thousands each month” and that its users are based all over the world. Recently, Money Brilliant received requests from people in the US who are interested in using the product in full capacity.

At the moment, Facebook is proving to be the most effective channel for user acquisition and engagement.

“Facebook works really well for us, we found. Obviously, the nature of Facebook, it gives us more than user acquisition; it's giving us incredible insight into how people are feeling about our service. We’re getting a lot of reviews on there. We've been blown away by how many people are actually sharing our ad!” said Enright.

MoneyBrilliant is gearing up for an aggressive rollout of product developments beyond the current cash management service to move customers towards longer term financial well-being and to help users maximise their savings.

Lord admitted it’s been a rocky four-year startup journey, however, the ‘thank you’ notes he gets from users make it all worthwhile.

“I couldn't actually help my mum because she's in retirement now, but we're helping so many other Australians, taking away their stress. I love getting notes saying 'thank you',” said Lord.

Featured image (L to R): Jemma Enright, Co-Founder & CEO and Peter Lord, Founder, MoneyBrilliant. Source: Provided.

OpenLearning and Smart Sparrow partner to offer educators easier course creation through platform integration

Image: Smart Sparrow's Dr Dror Ben-Naim and OpenLearning's Adam Brimo.

StartupWeek Sydney launches to celebrate and strengthen the city’s startup ecosystem

It will also seek to facilitate deeper engagement between startups and investors, government, and corporate organisations, with organisers expecting 5000 attendees across 22 venues including NSW Parliament House, UNSW and UTS, recently opened FinTech startup hub Stone & Chalk, and Fishburners.

Michelle Williams, national manager of StartupWeek Australia, said the event will showcase a Sydney startup community "which has never seen this level of energy and momentum."

“Global economic uncertainty is contributing to a new focus on innovation and entrepreneurialism here in Australia. As whole industries face digital disruption, now is the time to catalyse existing and aspiring entrepreneurs to build and grow Australia’s innovation and growth opportunities," Williams said.

With startups a hot topic with governments around Australia at the moment, StartupWeek Sydney will be supported by the NSW Department of Industry and the City of Sydney.

Clover Moore, Lord Mayor of Sydney, said, “We want the thriving talent and long-term benefits of a fertile tech culture for Sydney, with local startups that lead their fields. Our support for StartupWeek is part of a long term strategy to help build the skilled and connected community we need to make that happen.”

Events include a breakfast and panel discussion on impact investing, a HealthTech hackathon at the Kinghorn Cancer Centre in Darlinghurst, a networking event for startups interested in the Chinese tech scene, and a Code Club Australia session at Town Hall, with a keynote speech from Code Club director and muru-D cofounder Annie Parker.

StartupWeek Sydney comes after the second successful Startup Week Melbourne was organised by Startup Victoria earlier this year, and follows on from the Startup Spring festival held around Australia this month.

StartupWeek will be looking to expand across Australia next year, with events in regional areas on the agenda.

Find out more about StartupWeek Sydney here.

NAB launches partnership with Sydney coworking community Fishburners

Construction safety startup Safesite names Dailius Wilson as vice president of sales as it focuses on US market

Wyatt Roy teams up with BlueChilli to run policy hackathon aimed at developing new policies for the innovation ecosystem

- Value proposition: Does the proposal address a clear and present problem in the innovation ecosystem, and has the problem been clearly articulated?

- Impact: Does the proposal contribute to making the innovation ecosystem stronger?

- Implementation: Is the proposal practical to implement; has the proposal identified required resources (public and private); has the proposal indicated who would be the relevant stakeholders? Is the proposal practically achievable in realistic timeframes?

- Value for money: Has consideration been made to proposal’s potential costs?

- International comparisons: Has anything similar been done internationally?

Sydney startup FlexCareers wants to help mothers get back into the workforce with flexible roles

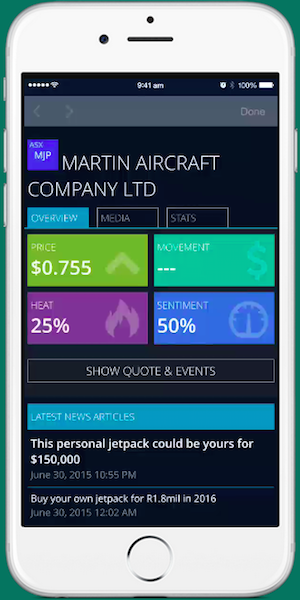

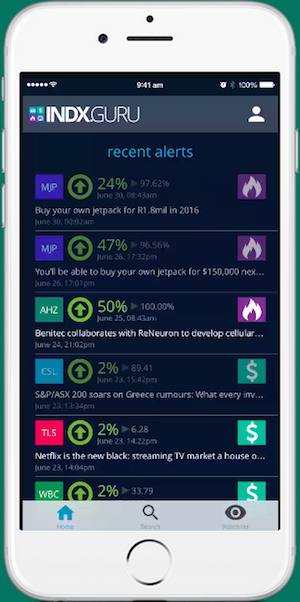

INDX.GURU is the latest fintech startup looking to decode the stock market and be a champion for everyday investors

INDX.GURU Mobile App, Overview[/caption]

[caption id="attachment_46259" align="alignleft" width="300"]

INDX.GURU Mobile App, Overview[/caption]

[caption id="attachment_46259" align="alignleft" width="300"] INDX.GURU Mobile App - Alerts[/caption]

INDX.GURU's humble beginnings dates back three years. A couple of disgruntled would-be investors thought ‘$38,000 a year is way too much to pay my financial advisors; surely there is solution that allows me to manage my investment portfolio’. This thought sent the co-founders of technology development house Scarlett Madz Media, Atkinson and Schrauth, on a technology odyssey to develop INDX.GURU. They realised very quickly they weren’t facing the problem in isolation, that other people were also frustrated with the costs involved with managing their financial affairs. In fact, studies suggest from 2008 to 2013, unfair fees made up almost half of managed fund returns, with financial advisors profiting at the expense of consumers.

“It became clear that everybody who wasn’t a Broker or a Financial Advisor and who didn’t have the benefit of sitting behind a Bloomberg or IRIS terminal all day shared the same problem - to successfully research and monitor investments in the stock market using old fashioned methods is intimidating, expensive and increasingly ineffective for the independent investor,” the co-founders said.

“The knowledge gap between the powerful global financial gorillas and the everyday investor was forever widening.”

By creating INDX.GURU, Atkinson and Schraut aren’t just solving a problem (or several problems) for themselves. The addressable market is large. In 2014, 36 percent (almost 6.5 million) of the adult Australian population participated in the share market either directly via shares or other listed investments or indirectly via unlisted managed funds, according to the Australian Securities Exchange (ASX). While a big market means big opportunity, it’s also a big challenge. INDX.GURU is entering a $2 trillion investment industry dominated by the Big Four banks and their distribution networks. However, the Scarlett Madz Media team - the 11 of them are scattered across Sydney and Perth and are experienced in many industries including alcohol, marketing, retail and technology - seem to be well-poised for the challenge.

[caption id="attachment_46253" align="alignnone" width="969"]

INDX.GURU Mobile App - Alerts[/caption]

INDX.GURU's humble beginnings dates back three years. A couple of disgruntled would-be investors thought ‘$38,000 a year is way too much to pay my financial advisors; surely there is solution that allows me to manage my investment portfolio’. This thought sent the co-founders of technology development house Scarlett Madz Media, Atkinson and Schrauth, on a technology odyssey to develop INDX.GURU. They realised very quickly they weren’t facing the problem in isolation, that other people were also frustrated with the costs involved with managing their financial affairs. In fact, studies suggest from 2008 to 2013, unfair fees made up almost half of managed fund returns, with financial advisors profiting at the expense of consumers.

“It became clear that everybody who wasn’t a Broker or a Financial Advisor and who didn’t have the benefit of sitting behind a Bloomberg or IRIS terminal all day shared the same problem - to successfully research and monitor investments in the stock market using old fashioned methods is intimidating, expensive and increasingly ineffective for the independent investor,” the co-founders said.

“The knowledge gap between the powerful global financial gorillas and the everyday investor was forever widening.”

By creating INDX.GURU, Atkinson and Schraut aren’t just solving a problem (or several problems) for themselves. The addressable market is large. In 2014, 36 percent (almost 6.5 million) of the adult Australian population participated in the share market either directly via shares or other listed investments or indirectly via unlisted managed funds, according to the Australian Securities Exchange (ASX). While a big market means big opportunity, it’s also a big challenge. INDX.GURU is entering a $2 trillion investment industry dominated by the Big Four banks and their distribution networks. However, the Scarlett Madz Media team - the 11 of them are scattered across Sydney and Perth and are experienced in many industries including alcohol, marketing, retail and technology - seem to be well-poised for the challenge.

[caption id="attachment_46253" align="alignnone" width="969"] INDX.GURU Perth team. Source: Provided.[/caption]

The technology team at Scarlett Madz Media originally embarked on building their own search engine to power their idea. The search engine and a prototype of INDX.GURU was built within a year. Three years later, after significant capital investment by the co-founders, the search engine has been mothballed.

Over the years, development took many different turns, and the team built an array of proprietary technology and custom algorithms to house the investment metrics that fuel INDX.GURU today.

The co-founders stressed that INDX.GURU is market agnostic. Although Australia has been used as the test market, the platform can easily and quickly be populated with data from any market, making it a global opportunity for its users. The business model can just as easily be replicated in other markets, making it a global opportunity for the startup as well.

The overall reaction to INDX.GURU during its alpha testing phase has been very positive, according to the co-founders.

“People love the user interface and cannot believe the extent of the media monitoring. The Sentiment and Heat readings get special kudos, as does the presentation of the easily digestible financial information,” said Atkinson and Schrauth.

“The more technology-savvy tester applauded the speed in which the real time data was delivered.”

INDX.GURU launched its private beta test last month and well over 1,000 people have registered to become early adopters. Upon completion of the beta test, the startup is hoping to attract a sizable user base using three distinct market channels. Principally, through growth hacking techniques, INDX.GURU is hoping to build a loyal base of self-directed investors. These users will have the option of getting a base service, which encompasses access to news, social media, blogs, video and critical financial data on all ASX companies, for free. However, a premium and professional ‘paid’ version will be available at a later date.

The second channel involves accessing users indirectly by forming partnerships with wealth managers, broking firms and financial advisors. INDX.GURU is finalising its Advisor Assist platform which provides real-time user information to brokers and financial advisors, and designed to facilitate more relevant and direct communication between them and their customers. The startup hopes this will drive transactions and also cement customer loyalty.

The third channel involves licensing INDX.GURU content to media companies interested in providing their users/customers with an enhanced information service related to the business news section of their digital publications.

“Access to INDX.GURU for media companies will help build digital customer loyalty, reduce churn, enhance advertising revenue opportunities and create opportunities to participate in transactional revenue,” the co-founders said.

INDX.GURU has been self-funded to date, however the team is in the process of raising a Series A round to assist with growth activities and international expansion.

Thought the platform is yet to be launched publicly in Australia, Atkinson and Schrauth already have their sights set on the US market. INDX.GURU's US content platform is well developed, and the co-founders are hoping to start working on US-based distribution partnerships towards the end of the year.

It’s unclear which fintech startup will win in this space, but it will likely be the one with the best UI/UX - that is, the UI/UX that most of the users want and feel comfortable with. Given how large the market is and how diverse stock market participants are, there is room for multiple homegrown success stories.

INDX.GURU Perth team. Source: Provided.[/caption]

The technology team at Scarlett Madz Media originally embarked on building their own search engine to power their idea. The search engine and a prototype of INDX.GURU was built within a year. Three years later, after significant capital investment by the co-founders, the search engine has been mothballed.

Over the years, development took many different turns, and the team built an array of proprietary technology and custom algorithms to house the investment metrics that fuel INDX.GURU today.

The co-founders stressed that INDX.GURU is market agnostic. Although Australia has been used as the test market, the platform can easily and quickly be populated with data from any market, making it a global opportunity for its users. The business model can just as easily be replicated in other markets, making it a global opportunity for the startup as well.

The overall reaction to INDX.GURU during its alpha testing phase has been very positive, according to the co-founders.

“People love the user interface and cannot believe the extent of the media monitoring. The Sentiment and Heat readings get special kudos, as does the presentation of the easily digestible financial information,” said Atkinson and Schrauth.

“The more technology-savvy tester applauded the speed in which the real time data was delivered.”

INDX.GURU launched its private beta test last month and well over 1,000 people have registered to become early adopters. Upon completion of the beta test, the startup is hoping to attract a sizable user base using three distinct market channels. Principally, through growth hacking techniques, INDX.GURU is hoping to build a loyal base of self-directed investors. These users will have the option of getting a base service, which encompasses access to news, social media, blogs, video and critical financial data on all ASX companies, for free. However, a premium and professional ‘paid’ version will be available at a later date.

The second channel involves accessing users indirectly by forming partnerships with wealth managers, broking firms and financial advisors. INDX.GURU is finalising its Advisor Assist platform which provides real-time user information to brokers and financial advisors, and designed to facilitate more relevant and direct communication between them and their customers. The startup hopes this will drive transactions and also cement customer loyalty.

The third channel involves licensing INDX.GURU content to media companies interested in providing their users/customers with an enhanced information service related to the business news section of their digital publications.

“Access to INDX.GURU for media companies will help build digital customer loyalty, reduce churn, enhance advertising revenue opportunities and create opportunities to participate in transactional revenue,” the co-founders said.

INDX.GURU has been self-funded to date, however the team is in the process of raising a Series A round to assist with growth activities and international expansion.

Thought the platform is yet to be launched publicly in Australia, Atkinson and Schrauth already have their sights set on the US market. INDX.GURU's US content platform is well developed, and the co-founders are hoping to start working on US-based distribution partnerships towards the end of the year.

It’s unclear which fintech startup will win in this space, but it will likely be the one with the best UI/UX - that is, the UI/UX that most of the users want and feel comfortable with. Given how large the market is and how diverse stock market participants are, there is room for multiple homegrown success stories.

Featured image. INDX.GURU Sydney team. Source: Provided.

Hart: Ldn’s interior design marketplace is holding its own by curating a network of Australian designers

Collaborate Corporation ventures into fintech territory with investment in BlueChilli startup FundX

Collaborate's CEO Chris Noone, who is joining FundX's board as a non-executive director, said the company's investment in FundX is a "great opportunity to disrupt the highly profitable yet inflexible and antiquated banking sector."

"ABS data suggests that access to finance is the most common barrier to innovation, affecting around 400,000 businesses locally. It’s a big problem that requires smart solutions," said Noone.

“We are very excited to be involved with FundX in exploring peer-to-peer and fintech opportunities in an SME market that is worth over $120 billion in Australia. FundX is able to leverage Collaborate’s peer-to-peer and marketplace skills and knowledge, while we simultaneously address significant opportunities in the fintech sector.”

From a distance, it appears Collaborate is emerging from the pack as a market leader in the collaborative consumption and peer-to-peer business space, so there is certainly merit in the company's strategy to own little bit of every vertical to see what takes off.

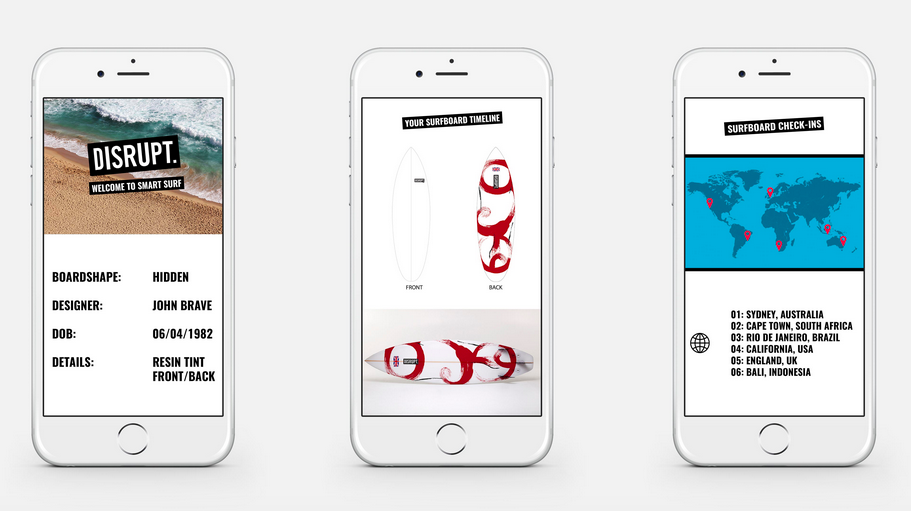

Disrupt launches ‘connected surfboard’ that captures location data so surfers can log the journey of their boards

disruptsurfing.com[/caption]

The launch also comes a few months after Disrupt launched in Europe, setting up its European headquarters in the UK after signing marketing partnerships with popular outdoor sports brands including WaveLength and Animal and making distribution agreements with a number of retailers.

The startup, which was part of the second class of the muru-D accelerator, has already created over 1500 boards for customers around Australia and Asia. After a foray into China, Disrupt has brought all their manufacturing home again, with all boards now made in Australia.

The plan is to eventually offer a wider range of 'smart' customised equipment across different sports.

disruptsurfing.com[/caption]

The launch also comes a few months after Disrupt launched in Europe, setting up its European headquarters in the UK after signing marketing partnerships with popular outdoor sports brands including WaveLength and Animal and making distribution agreements with a number of retailers.

The startup, which was part of the second class of the muru-D accelerator, has already created over 1500 boards for customers around Australia and Asia. After a foray into China, Disrupt has brought all their manufacturing home again, with all boards now made in Australia.

The plan is to eventually offer a wider range of 'smart' customised equipment across different sports.

EdTech startup Fluid Education wins Lenovo Choice award at INCUBATE demo day

Featured Image: Matt Codrington, Managing Director, Lenovo ANZ; Giorgio Doueihi, Co-Founder, Fluid Education; James Alexander, Founder, INCUBATE. Source: Provided.

Startup WithWine is like a wine festival in an app that helps consumers buy wine based on word of mouth

Featured image: Richard Owens, Founder, WithWine. Source: Provided.

UrbanOutsource raises a $500,000 seed round led by Grand Prix Capital