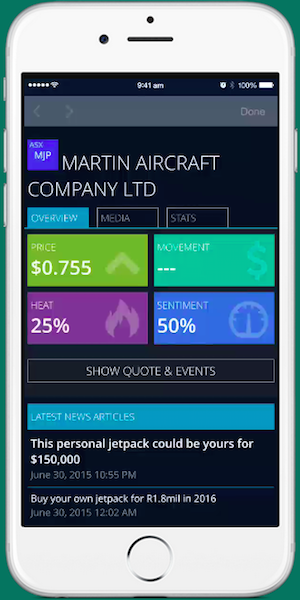

INDX.GURU Mobile App, Overview[/caption]

[caption id="attachment_46259" align="alignleft" width="300"]

INDX.GURU Mobile App, Overview[/caption]

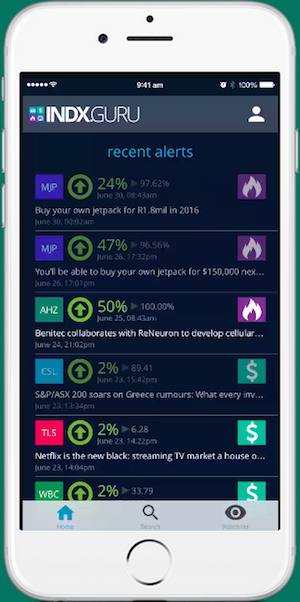

[caption id="attachment_46259" align="alignleft" width="300"] INDX.GURU Mobile App - Alerts[/caption]

INDX.GURU's humble beginnings dates back three years. A couple of disgruntled would-be investors thought ‘$38,000 a year is way too much to pay my financial advisors; surely there is solution that allows me to manage my investment portfolio’. This thought sent the co-founders of technology development house Scarlett Madz Media, Atkinson and Schrauth, on a technology odyssey to develop INDX.GURU. They realised very quickly they weren’t facing the problem in isolation, that other people were also frustrated with the costs involved with managing their financial affairs. In fact, studies suggest from 2008 to 2013, unfair fees made up almost half of managed fund returns, with financial advisors profiting at the expense of consumers.

“It became clear that everybody who wasn’t a Broker or a Financial Advisor and who didn’t have the benefit of sitting behind a Bloomberg or IRIS terminal all day shared the same problem - to successfully research and monitor investments in the stock market using old fashioned methods is intimidating, expensive and increasingly ineffective for the independent investor,” the co-founders said.

“The knowledge gap between the powerful global financial gorillas and the everyday investor was forever widening.”

By creating INDX.GURU, Atkinson and Schraut aren’t just solving a problem (or several problems) for themselves. The addressable market is large. In 2014, 36 percent (almost 6.5 million) of the adult Australian population participated in the share market either directly via shares or other listed investments or indirectly via unlisted managed funds, according to the Australian Securities Exchange (ASX). While a big market means big opportunity, it’s also a big challenge. INDX.GURU is entering a $2 trillion investment industry dominated by the Big Four banks and their distribution networks. However, the Scarlett Madz Media team - the 11 of them are scattered across Sydney and Perth and are experienced in many industries including alcohol, marketing, retail and technology - seem to be well-poised for the challenge.

[caption id="attachment_46253" align="alignnone" width="969"]

INDX.GURU Mobile App - Alerts[/caption]

INDX.GURU's humble beginnings dates back three years. A couple of disgruntled would-be investors thought ‘$38,000 a year is way too much to pay my financial advisors; surely there is solution that allows me to manage my investment portfolio’. This thought sent the co-founders of technology development house Scarlett Madz Media, Atkinson and Schrauth, on a technology odyssey to develop INDX.GURU. They realised very quickly they weren’t facing the problem in isolation, that other people were also frustrated with the costs involved with managing their financial affairs. In fact, studies suggest from 2008 to 2013, unfair fees made up almost half of managed fund returns, with financial advisors profiting at the expense of consumers.

“It became clear that everybody who wasn’t a Broker or a Financial Advisor and who didn’t have the benefit of sitting behind a Bloomberg or IRIS terminal all day shared the same problem - to successfully research and monitor investments in the stock market using old fashioned methods is intimidating, expensive and increasingly ineffective for the independent investor,” the co-founders said.

“The knowledge gap between the powerful global financial gorillas and the everyday investor was forever widening.”

By creating INDX.GURU, Atkinson and Schraut aren’t just solving a problem (or several problems) for themselves. The addressable market is large. In 2014, 36 percent (almost 6.5 million) of the adult Australian population participated in the share market either directly via shares or other listed investments or indirectly via unlisted managed funds, according to the Australian Securities Exchange (ASX). While a big market means big opportunity, it’s also a big challenge. INDX.GURU is entering a $2 trillion investment industry dominated by the Big Four banks and their distribution networks. However, the Scarlett Madz Media team - the 11 of them are scattered across Sydney and Perth and are experienced in many industries including alcohol, marketing, retail and technology - seem to be well-poised for the challenge.

[caption id="attachment_46253" align="alignnone" width="969"] INDX.GURU Perth team. Source: Provided.[/caption]

The technology team at Scarlett Madz Media originally embarked on building their own search engine to power their idea. The search engine and a prototype of INDX.GURU was built within a year. Three years later, after significant capital investment by the co-founders, the search engine has been mothballed.

Over the years, development took many different turns, and the team built an array of proprietary technology and custom algorithms to house the investment metrics that fuel INDX.GURU today.

The co-founders stressed that INDX.GURU is market agnostic. Although Australia has been used as the test market, the platform can easily and quickly be populated with data from any market, making it a global opportunity for its users. The business model can just as easily be replicated in other markets, making it a global opportunity for the startup as well.

The overall reaction to INDX.GURU during its alpha testing phase has been very positive, according to the co-founders.

“People love the user interface and cannot believe the extent of the media monitoring. The Sentiment and Heat readings get special kudos, as does the presentation of the easily digestible financial information,” said Atkinson and Schrauth.

“The more technology-savvy tester applauded the speed in which the real time data was delivered.”

INDX.GURU launched its private beta test last month and well over 1,000 people have registered to become early adopters. Upon completion of the beta test, the startup is hoping to attract a sizable user base using three distinct market channels. Principally, through growth hacking techniques, INDX.GURU is hoping to build a loyal base of self-directed investors. These users will have the option of getting a base service, which encompasses access to news, social media, blogs, video and critical financial data on all ASX companies, for free. However, a premium and professional ‘paid’ version will be available at a later date.

The second channel involves accessing users indirectly by forming partnerships with wealth managers, broking firms and financial advisors. INDX.GURU is finalising its Advisor Assist platform which provides real-time user information to brokers and financial advisors, and designed to facilitate more relevant and direct communication between them and their customers. The startup hopes this will drive transactions and also cement customer loyalty.

The third channel involves licensing INDX.GURU content to media companies interested in providing their users/customers with an enhanced information service related to the business news section of their digital publications.

“Access to INDX.GURU for media companies will help build digital customer loyalty, reduce churn, enhance advertising revenue opportunities and create opportunities to participate in transactional revenue,” the co-founders said.

INDX.GURU has been self-funded to date, however the team is in the process of raising a Series A round to assist with growth activities and international expansion.

Thought the platform is yet to be launched publicly in Australia, Atkinson and Schrauth already have their sights set on the US market. INDX.GURU's US content platform is well developed, and the co-founders are hoping to start working on US-based distribution partnerships towards the end of the year.

It’s unclear which fintech startup will win in this space, but it will likely be the one with the best UI/UX - that is, the UI/UX that most of the users want and feel comfortable with. Given how large the market is and how diverse stock market participants are, there is room for multiple homegrown success stories.

INDX.GURU Perth team. Source: Provided.[/caption]

The technology team at Scarlett Madz Media originally embarked on building their own search engine to power their idea. The search engine and a prototype of INDX.GURU was built within a year. Three years later, after significant capital investment by the co-founders, the search engine has been mothballed.

Over the years, development took many different turns, and the team built an array of proprietary technology and custom algorithms to house the investment metrics that fuel INDX.GURU today.

The co-founders stressed that INDX.GURU is market agnostic. Although Australia has been used as the test market, the platform can easily and quickly be populated with data from any market, making it a global opportunity for its users. The business model can just as easily be replicated in other markets, making it a global opportunity for the startup as well.

The overall reaction to INDX.GURU during its alpha testing phase has been very positive, according to the co-founders.

“People love the user interface and cannot believe the extent of the media monitoring. The Sentiment and Heat readings get special kudos, as does the presentation of the easily digestible financial information,” said Atkinson and Schrauth.

“The more technology-savvy tester applauded the speed in which the real time data was delivered.”

INDX.GURU launched its private beta test last month and well over 1,000 people have registered to become early adopters. Upon completion of the beta test, the startup is hoping to attract a sizable user base using three distinct market channels. Principally, through growth hacking techniques, INDX.GURU is hoping to build a loyal base of self-directed investors. These users will have the option of getting a base service, which encompasses access to news, social media, blogs, video and critical financial data on all ASX companies, for free. However, a premium and professional ‘paid’ version will be available at a later date.

The second channel involves accessing users indirectly by forming partnerships with wealth managers, broking firms and financial advisors. INDX.GURU is finalising its Advisor Assist platform which provides real-time user information to brokers and financial advisors, and designed to facilitate more relevant and direct communication between them and their customers. The startup hopes this will drive transactions and also cement customer loyalty.

The third channel involves licensing INDX.GURU content to media companies interested in providing their users/customers with an enhanced information service related to the business news section of their digital publications.

“Access to INDX.GURU for media companies will help build digital customer loyalty, reduce churn, enhance advertising revenue opportunities and create opportunities to participate in transactional revenue,” the co-founders said.

INDX.GURU has been self-funded to date, however the team is in the process of raising a Series A round to assist with growth activities and international expansion.

Thought the platform is yet to be launched publicly in Australia, Atkinson and Schrauth already have their sights set on the US market. INDX.GURU's US content platform is well developed, and the co-founders are hoping to start working on US-based distribution partnerships towards the end of the year.

It’s unclear which fintech startup will win in this space, but it will likely be the one with the best UI/UX - that is, the UI/UX that most of the users want and feel comfortable with. Given how large the market is and how diverse stock market participants are, there is room for multiple homegrown success stories.

Featured image. INDX.GURU Sydney team. Source: Provided.