(Annual Recurring Revenue x Gross Margin) (% Churn + Discount Rate)

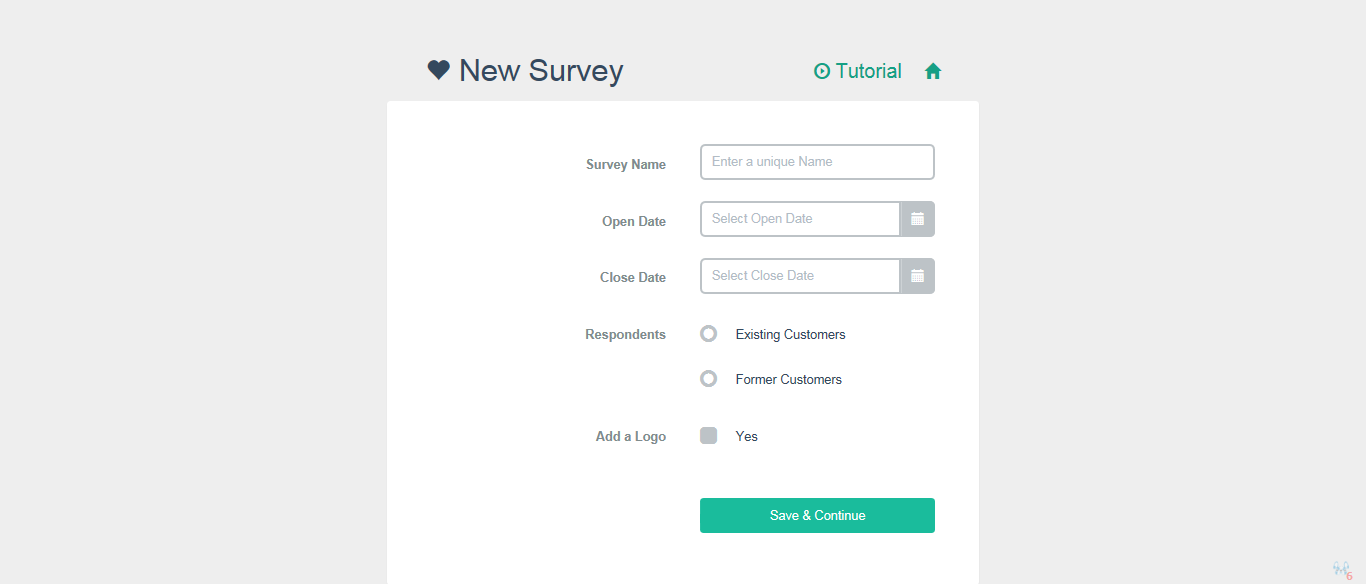

Another way to measure CLV is by dividing revenue per customer per month by monthly churn rate (percentage of customers lost in that month). According to Kupor and Kasireddy, a company’s business model is working if the CLV is three times greater than the customer acquisition cost (CAC is measured by dividing quarterly sales and marketing expense for a company by the number of new customers acquired that quarter). However, if the CLV is close to or less than the CAC, then this suggests the company - Kupor and Kasireddy is specifically referring to Software-as-a-Service (SaaS) companies - is spending more acquire a customer than the discounted positive cash flow that will come from that customer over the customer’s lifetime. “This could be because the company hasn’t figured out how to effectively monetize its customers. Or that customers are leaving them before they’ve spent enough money on the platform to cover the costs to acquire them. Or that the company hasn’t figured out an effective way to scale its customer acquisition costs,” Kupor and Kasireddy writes. What Valuiza essentially does is it enables companies to measure the strength of customer relationships and identify why certain relationships are weak or short-lived. By using Valuiza, users are able to more accurately predict customer profitability due to the insights generated from Valuiza’s smart customer surveys and make more informed decisions about things like marketing investments, customer retention, and growth opportunities (e.g. referral initiatives). The insights delivered via the surveys make it easier for users to segment a customer base, identify at-risk relationships and their value to the business, and assess the impact of investing in customer relationships. Specifically, it’s a three-step process for the user/subscriber: Step 1 involves scheduling a survey to collect feedback from either existing customers or former customers. Users then use the survey link that Valuiza generates to invite existing or former customers to complete the survey. Invitations can be issued via email, SMS or social media. [caption id="attachment_46448" align="alignnone" width="1366"] Valuiza - New Survey.[/caption]

[caption id="attachment_46451" align="alignnone" width="786"]

Valuiza - New Survey.[/caption]

[caption id="attachment_46451" align="alignnone" width="786"] Valuiza - Survey Sentiments.[/caption]

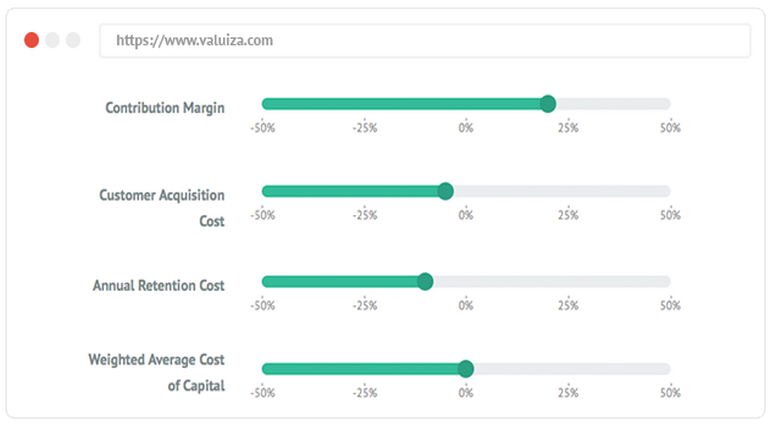

Step 2 involves the user inputting some historical financial and other data associated with the customer group being surveyed like contribution margin, estimated customer referral rate, customer acquisition cost, annual retention cost and rate, and weighted average cost of capital. These data inputs are usually available within the user’s financial and CRM systems or can be obtained with the help of accountants or financial advisors. Once all the data has been put into the system, Valuiza automatically calculates the company’s CLV. And after all the survey responses have been collected and analysed by Valuiza - responses are anonymised and retained as confidential data - it will automatically adjust the CLV so that users have updated information about the future value of customers based on actual customer feedback. The algorithms used to calculate CLV are based on a range of data inputs that represent the key variables driving future customer lifetime value.

[caption id="attachment_46453" align="alignnone" width="774"]

Valuiza - Survey Sentiments.[/caption]

Step 2 involves the user inputting some historical financial and other data associated with the customer group being surveyed like contribution margin, estimated customer referral rate, customer acquisition cost, annual retention cost and rate, and weighted average cost of capital. These data inputs are usually available within the user’s financial and CRM systems or can be obtained with the help of accountants or financial advisors. Once all the data has been put into the system, Valuiza automatically calculates the company’s CLV. And after all the survey responses have been collected and analysed by Valuiza - responses are anonymised and retained as confidential data - it will automatically adjust the CLV so that users have updated information about the future value of customers based on actual customer feedback. The algorithms used to calculate CLV are based on a range of data inputs that represent the key variables driving future customer lifetime value.

[caption id="attachment_46453" align="alignnone" width="774"] Valuiza - Data Inputs.[/caption]

[caption id="attachment_46452" align="alignnone" width="780"]

Valuiza - Data Inputs.[/caption]

[caption id="attachment_46452" align="alignnone" width="780"] Valuiza - CLV.[/caption]

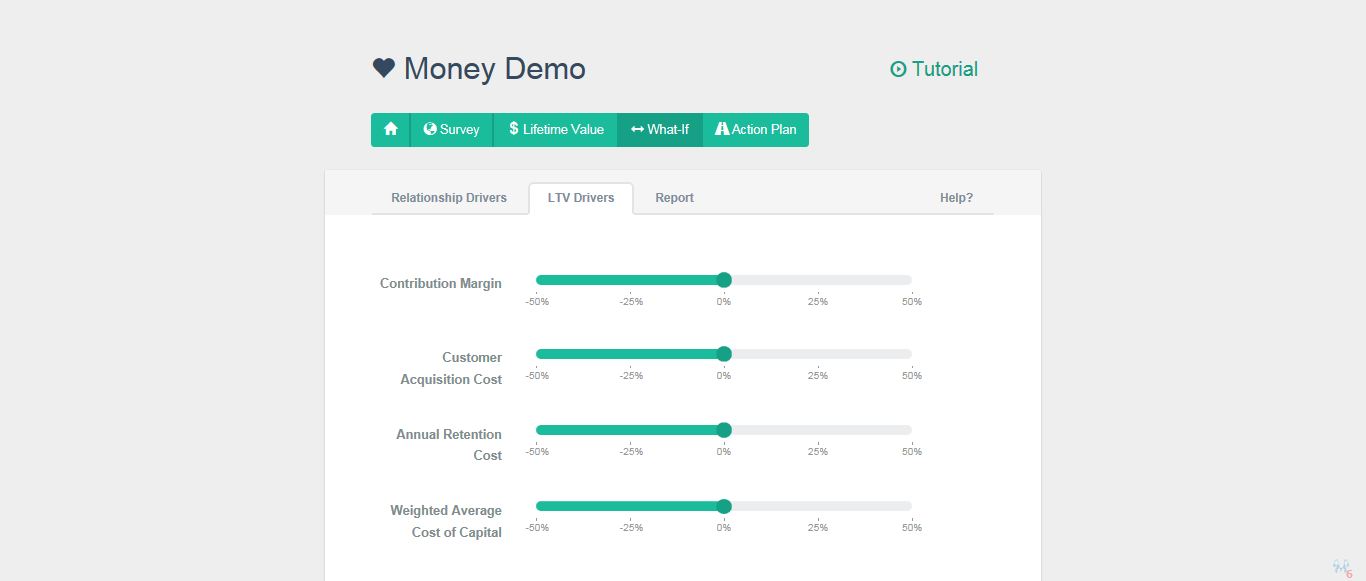

Step 3 involves using Vauiza’s ‘What If’ tool to quantify the financial impact of any proposed changes to either the customer relationship drivers or CLV drivers. As an adjunct to this step, Valuiza also automatically produces an ‘Action Plan’ that reports all results and offers suggestions about the areas to focus on to improve business outcomes.

[caption id="attachment_46447" align="alignnone" width="1366"]

Valuiza - CLV.[/caption]

Step 3 involves using Vauiza’s ‘What If’ tool to quantify the financial impact of any proposed changes to either the customer relationship drivers or CLV drivers. As an adjunct to this step, Valuiza also automatically produces an ‘Action Plan’ that reports all results and offers suggestions about the areas to focus on to improve business outcomes.

[caption id="attachment_46447" align="alignnone" width="1366"] Valuiza - What If Tool.[/caption]

Valuiza was officially founded in March 2014, however, its humble beginnings date back several years. Dr Ray McHale, an accountant with over 10 years of experience consulting Australian financial companies, was working in financial services and became frustrated with the industry’s inability to measure the strength of customer relationships and how that impacts a company’s bottom line. McHale could not find any suitable tools out there in the market and embarked on a mission to create his own. He completed a doctorate in relationship marketing, and in the process, was able to successfully validate approaches for measuring customer relationships and linking the outcomes to a business’ bottom line. McHale then applied for, and was granted, patents in four countries - Australia, New Zealand, the US and Singapore.

McHale was later joined by CTO Pushpinder Bagga, who brought McHale’s years of research and vision to life in just 45 days. Valuiza, as it exists today, is the digital embodiment of McHale’s IP.

“Valuiza encapsulates that IP in a practical and easy-to-use cloud-based service. Its uniqueness lies in the ability to quickly obtain customer feedback, identify valuable insights about customer experience and intentions, and combine that data with historical financial results to predict their value to a business,” McHale explained.

“As more and more businesses recognise that we live in the ‘age of the customer’ where customer experience has become the defining success factor, we believe that leading customer metrics such as our proprietary ‘Strength of Relationship Index’ (StoRI) and the use of customer lifetime value will gain significant traction and disrupt traditional approaches to managing customer relationships.”

Although Valuiza can be used by any business that expects to have ongoing economic relationships with its customers (i.e. more than a single sales transaction), it’s initially targeting companies operating in Australia’s financial advisory industry - these include financial planners, insurance brokers and finance brokers.

The reason for this, McHale explained, is because “there is a lot of disruption occurring and fundamental business models are in the process of shifting from an essentially product-focused approach to fee-for-service where consumers are taking control and demanding that service providers put them at the centre of everything they do - and deliver value.”

That said, McHale believes Valuiza can add a lot of value across many markets, and that even investors can use the platform to monitor customer profitability in startups in their investment portfolio.

Niki Scevak, co-founder of venture capital firm Blackbird VC, told Startup Daily CLV is “quite simply everything”.

“Customer Lifetime Value is essentially a measure of how happy customers are and how happy customers is the only factor in determining whether there is a business or not,” said Scevak.

He pointed out, however, that CLV is a tricky metric to measure.

"CLV can be approximated in crude ways in a SaaS business ... but unfortunately it takes a lifetime to measure customer lifetime value in earnest," said Scevak.

In an article, Bill Gurley, Partner at venture capital firm Benchmark, warns that an over-focus on the CLV formula can be detrimental to a business, that it should be seen strictly as a tool, not a strategy. Many companies (especially the marketing departments of companies) have manipulated the formula to rationalise, or make it fit with, their marketing strategy.

“The LTV formula is a measurement tool to be used by marketing to test the effectiveness of their marketing spend – nothing more and nothing less,” Gurley writes.

“If one asserts that buying customers below what they charge them is a corporate strategy, this is in essence an arbitrage game, and arbitrage games rarely last.”

McHale doesn’t believe Valuiza has any direct competitors that have been able to connect customer feedback to a business’ bottom line, and offer the quality and practicality of the insights that Valuiza delivers.

“There are lots of online survey providers in the market and they do a good job of enabling customer feedback collection. But the biggest problems faced by businesses are that they find it really challenge to ask the right questions and use the survey results to improve their performance,” McHale said.

Like other SaaS companies, Valuiza operates on a multi-tiered subscription model. Users can choose from three monthly subscription plans: Starter Plan ($29/month), Growth Plan ($99/month) and Professional Plan ($149/month). The plans are based on a range of functions and advanced features that suit businesses of varying sizes. McHale said Valuiza is now investing in expanding its value proposition to help users generate new customer leads.

Valuiza has been in beta since its launch in September last year. The startup has been collecting feedback from users to identify what changes need to made and what advanced features need to be integrated to improve the value of the platform and establish product-market fit.

McHale also said they’re in discussions with various industry stakeholders about adding sizeable ‘pilots’.

“[B]ased on that feedback, we’ll be in a strong position to execute on our growth strategy for Australia and eventually other countries,” McHale said.

Valuiza has been bootstrapped to date, which McHale admitted has been challenging. However, he said the startup is looking to raise seed funding in the near future, followed by a Series A round mid-2016. He believes focusing on the Australian financial advice market will put the startup in a strong position to raise growth capital.

Thus far, the biggest challenge for the Valuiza has been one communicated by many Australian startup founders - maintaining focus.

“It’s so easy to let events and circumstances dilute your focus, and before you know it, valuable time is lost and you have to work twice as hard to make up [for it],” said McHale.

Regardless, McHale is proud that they’re still in the game and kicking some early goals. Like many founders, he said the journey has been “a rollercoaster ride of highs and lows”.

“Our self-belief, grit and determination has got us to where we are today and that gives us a lot of confidence for the future because we have clear plans to be a significant player with a global presence,” said McHale.

Valuiza will be looking to expand into international markets towards end of the next year. There are also partnership opportunities in the startup’s radar. Partnerships with established companies, especially in the financial services and insurance industry, will allow Valuiza to leverage off those companies’ customer bases and grow faster.

Valuiza - What If Tool.[/caption]

Valuiza was officially founded in March 2014, however, its humble beginnings date back several years. Dr Ray McHale, an accountant with over 10 years of experience consulting Australian financial companies, was working in financial services and became frustrated with the industry’s inability to measure the strength of customer relationships and how that impacts a company’s bottom line. McHale could not find any suitable tools out there in the market and embarked on a mission to create his own. He completed a doctorate in relationship marketing, and in the process, was able to successfully validate approaches for measuring customer relationships and linking the outcomes to a business’ bottom line. McHale then applied for, and was granted, patents in four countries - Australia, New Zealand, the US and Singapore.

McHale was later joined by CTO Pushpinder Bagga, who brought McHale’s years of research and vision to life in just 45 days. Valuiza, as it exists today, is the digital embodiment of McHale’s IP.

“Valuiza encapsulates that IP in a practical and easy-to-use cloud-based service. Its uniqueness lies in the ability to quickly obtain customer feedback, identify valuable insights about customer experience and intentions, and combine that data with historical financial results to predict their value to a business,” McHale explained.

“As more and more businesses recognise that we live in the ‘age of the customer’ where customer experience has become the defining success factor, we believe that leading customer metrics such as our proprietary ‘Strength of Relationship Index’ (StoRI) and the use of customer lifetime value will gain significant traction and disrupt traditional approaches to managing customer relationships.”

Although Valuiza can be used by any business that expects to have ongoing economic relationships with its customers (i.e. more than a single sales transaction), it’s initially targeting companies operating in Australia’s financial advisory industry - these include financial planners, insurance brokers and finance brokers.

The reason for this, McHale explained, is because “there is a lot of disruption occurring and fundamental business models are in the process of shifting from an essentially product-focused approach to fee-for-service where consumers are taking control and demanding that service providers put them at the centre of everything they do - and deliver value.”

That said, McHale believes Valuiza can add a lot of value across many markets, and that even investors can use the platform to monitor customer profitability in startups in their investment portfolio.

Niki Scevak, co-founder of venture capital firm Blackbird VC, told Startup Daily CLV is “quite simply everything”.

“Customer Lifetime Value is essentially a measure of how happy customers are and how happy customers is the only factor in determining whether there is a business or not,” said Scevak.

He pointed out, however, that CLV is a tricky metric to measure.

"CLV can be approximated in crude ways in a SaaS business ... but unfortunately it takes a lifetime to measure customer lifetime value in earnest," said Scevak.

In an article, Bill Gurley, Partner at venture capital firm Benchmark, warns that an over-focus on the CLV formula can be detrimental to a business, that it should be seen strictly as a tool, not a strategy. Many companies (especially the marketing departments of companies) have manipulated the formula to rationalise, or make it fit with, their marketing strategy.

“The LTV formula is a measurement tool to be used by marketing to test the effectiveness of their marketing spend – nothing more and nothing less,” Gurley writes.

“If one asserts that buying customers below what they charge them is a corporate strategy, this is in essence an arbitrage game, and arbitrage games rarely last.”

McHale doesn’t believe Valuiza has any direct competitors that have been able to connect customer feedback to a business’ bottom line, and offer the quality and practicality of the insights that Valuiza delivers.

“There are lots of online survey providers in the market and they do a good job of enabling customer feedback collection. But the biggest problems faced by businesses are that they find it really challenge to ask the right questions and use the survey results to improve their performance,” McHale said.

Like other SaaS companies, Valuiza operates on a multi-tiered subscription model. Users can choose from three monthly subscription plans: Starter Plan ($29/month), Growth Plan ($99/month) and Professional Plan ($149/month). The plans are based on a range of functions and advanced features that suit businesses of varying sizes. McHale said Valuiza is now investing in expanding its value proposition to help users generate new customer leads.

Valuiza has been in beta since its launch in September last year. The startup has been collecting feedback from users to identify what changes need to made and what advanced features need to be integrated to improve the value of the platform and establish product-market fit.

McHale also said they’re in discussions with various industry stakeholders about adding sizeable ‘pilots’.

“[B]ased on that feedback, we’ll be in a strong position to execute on our growth strategy for Australia and eventually other countries,” McHale said.

Valuiza has been bootstrapped to date, which McHale admitted has been challenging. However, he said the startup is looking to raise seed funding in the near future, followed by a Series A round mid-2016. He believes focusing on the Australian financial advice market will put the startup in a strong position to raise growth capital.

Thus far, the biggest challenge for the Valuiza has been one communicated by many Australian startup founders - maintaining focus.

“It’s so easy to let events and circumstances dilute your focus, and before you know it, valuable time is lost and you have to work twice as hard to make up [for it],” said McHale.

Regardless, McHale is proud that they’re still in the game and kicking some early goals. Like many founders, he said the journey has been “a rollercoaster ride of highs and lows”.

“Our self-belief, grit and determination has got us to where we are today and that gives us a lot of confidence for the future because we have clear plans to be a significant player with a global presence,” said McHale.

Valuiza will be looking to expand into international markets towards end of the next year. There are also partnership opportunities in the startup’s radar. Partnerships with established companies, especially in the financial services and insurance industry, will allow Valuiza to leverage off those companies’ customer bases and grow faster.

Featured image: Dr Ray McHale, Founder, Valuiza. Source: Provided.